Amex Gold remains one of the most sought-after points-earning credit cards on the market, despite the recent increase in annual fees. Some of my work friends only have Amex Gold as their single credit card and have already racked up over 500K MR points from dining and grocery store spending since COVID-19.

Amex Gold 90-100K Referral Links

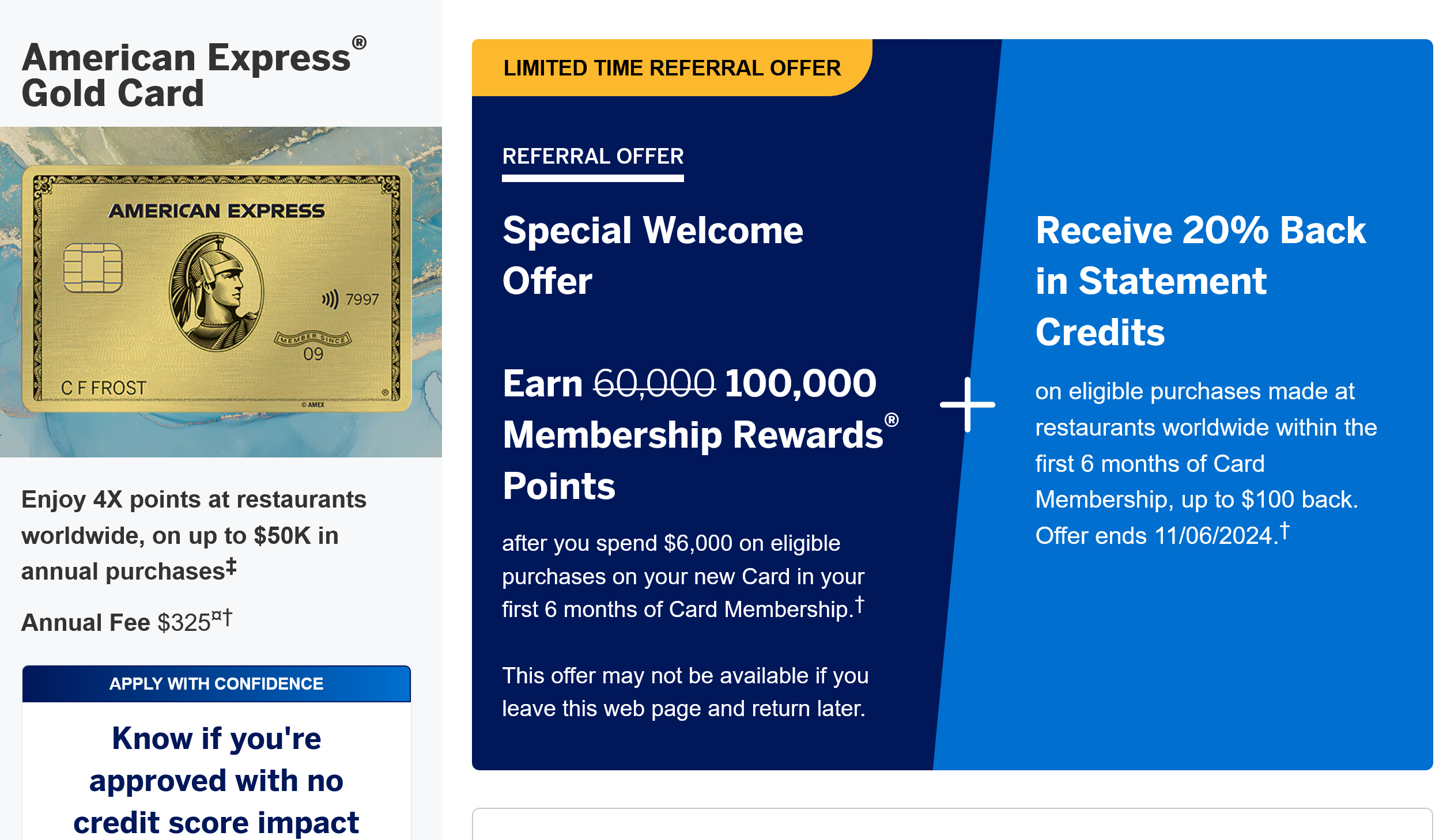

Amex is known to give special referral links (e.g., 90-100k referral and 30K MR points for each approved application) to people with only a single credit card. My two friends have been blessed with 100k (link) and 90k (link) referral links and they work consistently (no need for incognito mode) even though they both reached their yearly referral caps. My own referral link is never more than 60K and it is not worth sharing it with anyone.

Amex Gold’s Steep Annual Fee

Amex Gold carries a hefty annual fee ($325) compared to the Citi Strata Premium card ($95), which earns 3X points on dining, groceries and gas along with primary CDW auto insurance overseas (review). However, we highly regard MR points, which are especially useful for booking premium cabin flights from unique partnerships (e.g., ANA Mileage Club).

Getting the annual fee worth from Amex Gold

Amex Gold offers $420 in annual credits ($120 for eligible dining, $120 in Uber cash, $100 for Resy and $84 for Dunkin’). However, you must be organized to successfully claim all the annual credits (see table below).

First Step: Activate all the credits (enroll) in the “Rewards & Benefits” section of your Gold Card account (see image below). I know a few who never activated these credits and Amex is counting on people like them to make profits.

Amex Gold Card Credits & Earnings

| Annual Credits (US ONLY) | Tips to Maximize Earnings | NOTES |

| $120 ($10/month) Grubhub Dining Statement Credit | Order and pick up food to save on extra delivery fees. | Activation is required prior to receiving the benefit. |

| $120 ($10/month) Uber Riding/Dining Cash | Order and pick up food to save on extra delivery fees. | Amex Card (any) must be selected as the default payment method for the excess amount. |

| $100 ($50 every 6 months) Resy Credit | Look for available restaurants in your area on the Resy App or website. | You don't need to reserve or pay through Resy for this credit to post. |

| $84 ($7/month) Dunkin’ Credit | Activation is required prior to receiving the benefit. | |

| Amex Gold Earnings | ||

| 4x Membership Rewards points at restaurants & takeouts worldwide (50K annual cap) | It is hard to find overseas acceptance for Amex cards. | |

| 4x Membership Rewards points at U.S. supermarkets (25K annual cap). Excludes superstores (e.g., Walmart) and warehouse clubs (e.g., Sam's) | Mix grocery purchases with gift cards to earn 4X points (e.g., gas, Amazon etc.,). | Points claw-backs are possible from the Amex RAT team. |

| 3x Points On Flights | Use the Amex Platinum (if you have one) to earn 5x points on flights. | Must book directly with the airline or through Amex travel portal (Expedia bookings may earn 3X points) |

| Other Benefits | ||

| The Hotel Collection | $100 hotel credit and a room upgrade if available. | Must stay two or more nights. |

| ShopRunner Membership (free for any Amex card) | Free 2-day shipping & returns from stores like Under Armour, American Eagle, Tory Burch and Kate Spade. | SAKS 5th Avenue is no longer participating in free 2-day shipping. |

| Premium Car Rental Protection | Only useful if you don't have Chase Sapphire Preferred or Capital One Venture X cards, which provide primary car rental protection. | Any Amex card can be used to purchase this benefit. |

| Access to Amex Offers | Offers can be valuable if you check for them periodically. |

Best way to keep track of Amex credits

I recommend using your smartphone to create recurring calendar tasks or reminders to claim all the monthly Amex Gold credits. This process only gets harder when you mix personal Gold cards with Business Gold and Personal & Business Platinum cards.

Conclusion

Amex Gold card annual fee of ($325) is very close to the Capital One Venture X + Savor combo annual fee ($395) and makes you question if it is worth it for the one extra point earned for dining and groceries. I’ll still keep the Gold card for now due to my obsession with the Amex MR points ecosystem. I always wonder, why don’t other banks try to compete by offering 4x points on groceries and dining?